Whether you need just routine annual care (regular cleanings, checkups, x-rays, fluoride treatment, emergency exams) or extensive dental treatment, Direct Dental Savings can save you more than insurance.

Whether you need just routine annual care (regular cleanings, checkups, x-rays, fluoride treatment, emergency exams) or extensive dental treatment, Direct Dental Savings can save you more than insurance.

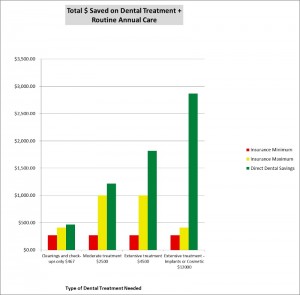

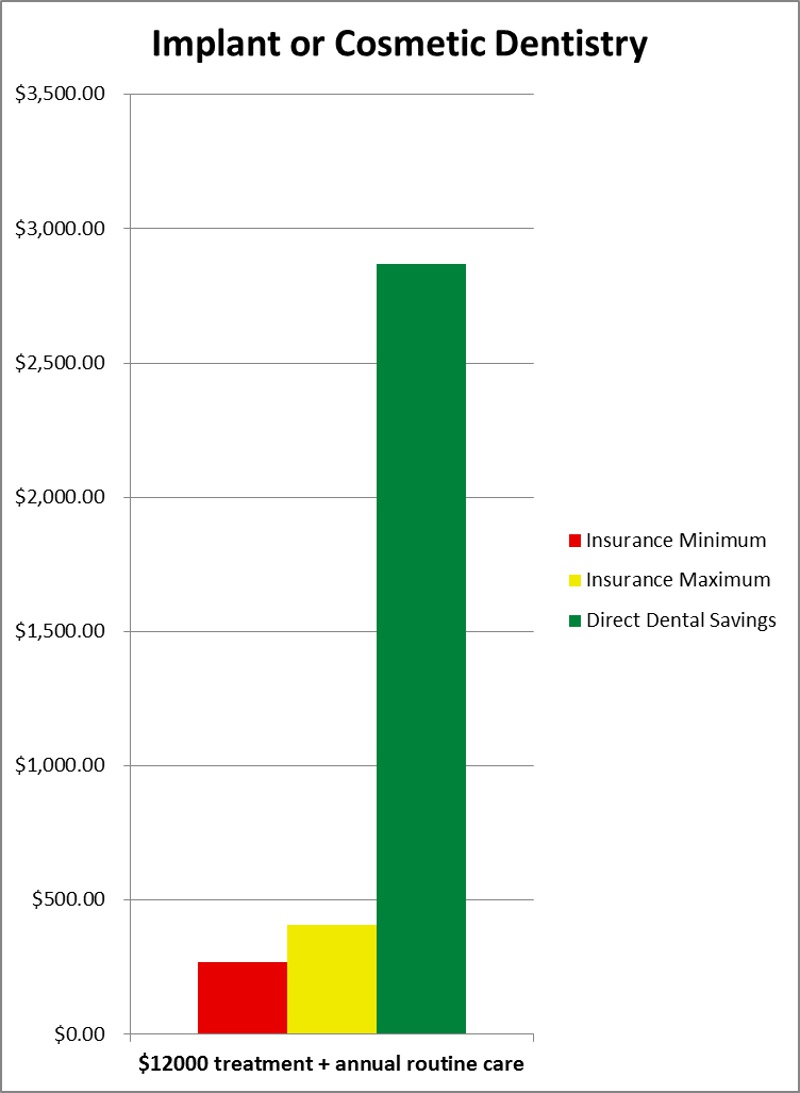

This graph shows all four of the examples listed below (see each for more details). Compare for yourself and save more with Direct Dental Savings.

Remember, with Direct Dental Savings your routine annual care is free. With insurance your routine annual care counts against your annual maximum payment and limits your savings on any other needed dentistry.

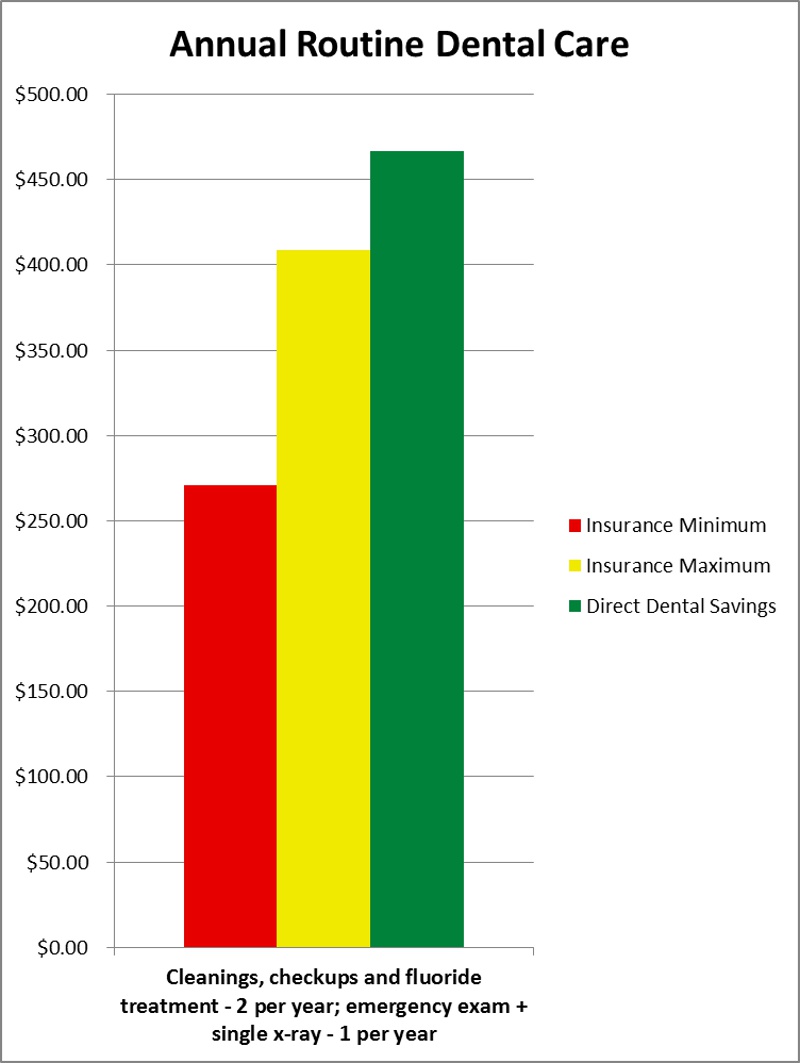

If your annual dental needs are limited, Direct Dental Savings can save you more than insurance. The Direct Dental Savings plan includes your regular cleanings, checkups exams, oral cancer exams, fluoride treatments (twice per year) and checkup x-rays and an emergency exam (once per year) for FREE. Dental insurance typically pays only a portion of these charges (with a large variance from policy to policy) and does not commonly pay for fluoride treatment in adults.

If your annual dental needs are limited, Direct Dental Savings can save you more than insurance. The Direct Dental Savings plan includes your regular cleanings, checkups exams, oral cancer exams, fluoride treatments (twice per year) and checkup x-rays and an emergency exam (once per year) for FREE. Dental insurance typically pays only a portion of these charges (with a large variance from policy to policy) and does not commonly pay for fluoride treatment in adults.

With cleanings, checkups, and fluoride treatment at a rate of twice per year Direct Dental Savings saved this individual over $50 from their insurance's maximum coverage.

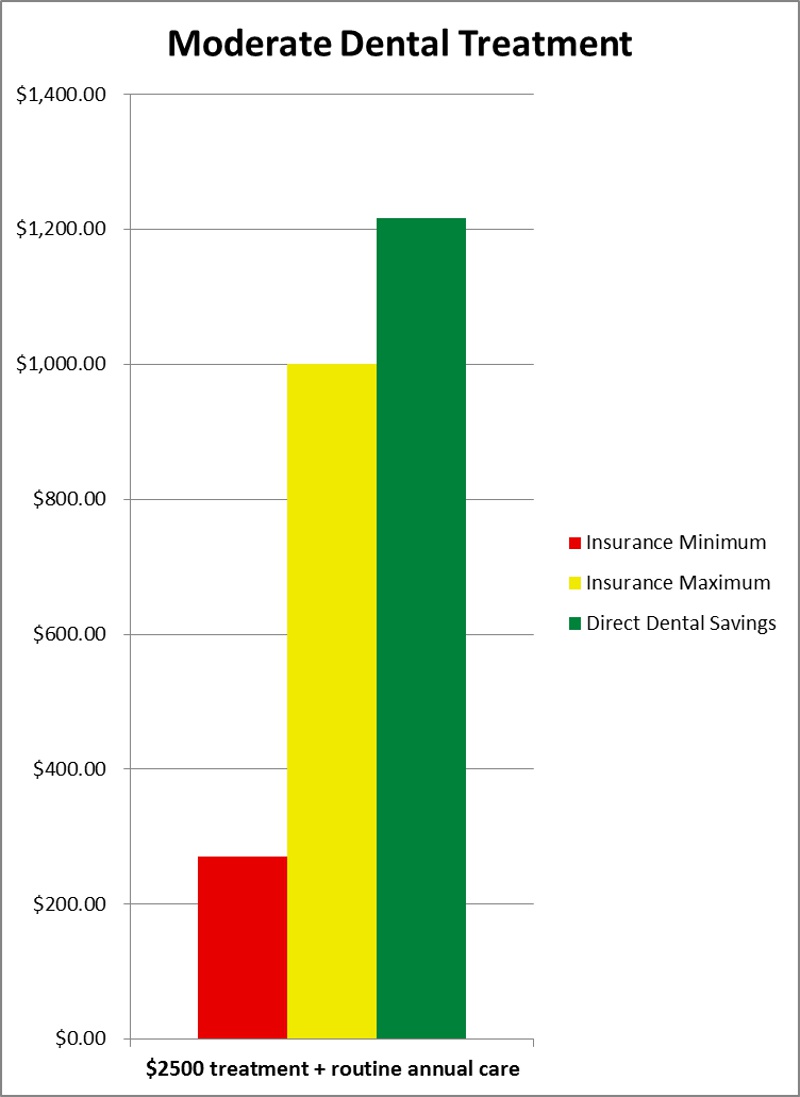

Compare the Direct Dental Savings plan to insurance on moderate treatment. If you need $2500 in dental treatment in addition to your routine annual care, the DDS plan can save you more. Insurance will always stop paying at the annual maximum benefit plan. Typically, we see this at $1000. In addition, depending upon the insurance policy restrictions (fee allowances, reimbursement percentages, procedural exclusions) you can see a range of payment from a low of $ up to the annual maximum benefit limit. But with insurance, you always have to sort through which procedures you are having done to decode what your insurance will pay and how much will be paid. Typically, this involves predetermination of benefits and lots of both time and paperwork. With Direct Dental Savings it is very simple, you can know virtually on the spot how much you’re going to save. Direct Dental Savings has no annual maximum, you simply save more!

Compare the Direct Dental Savings plan to insurance on moderate treatment. If you need $2500 in dental treatment in addition to your routine annual care, the DDS plan can save you more. Insurance will always stop paying at the annual maximum benefit plan. Typically, we see this at $1000. In addition, depending upon the insurance policy restrictions (fee allowances, reimbursement percentages, procedural exclusions) you can see a range of payment from a low of $ up to the annual maximum benefit limit. But with insurance, you always have to sort through which procedures you are having done to decode what your insurance will pay and how much will be paid. Typically, this involves predetermination of benefits and lots of both time and paperwork. With Direct Dental Savings it is very simple, you can know virtually on the spot how much you’re going to save. Direct Dental Savings has no annual maximum, you simply save more!

With a treatment totaling $2500, Direct Dental Savings saved this individual over $200 from their insurance's maximum coverage.

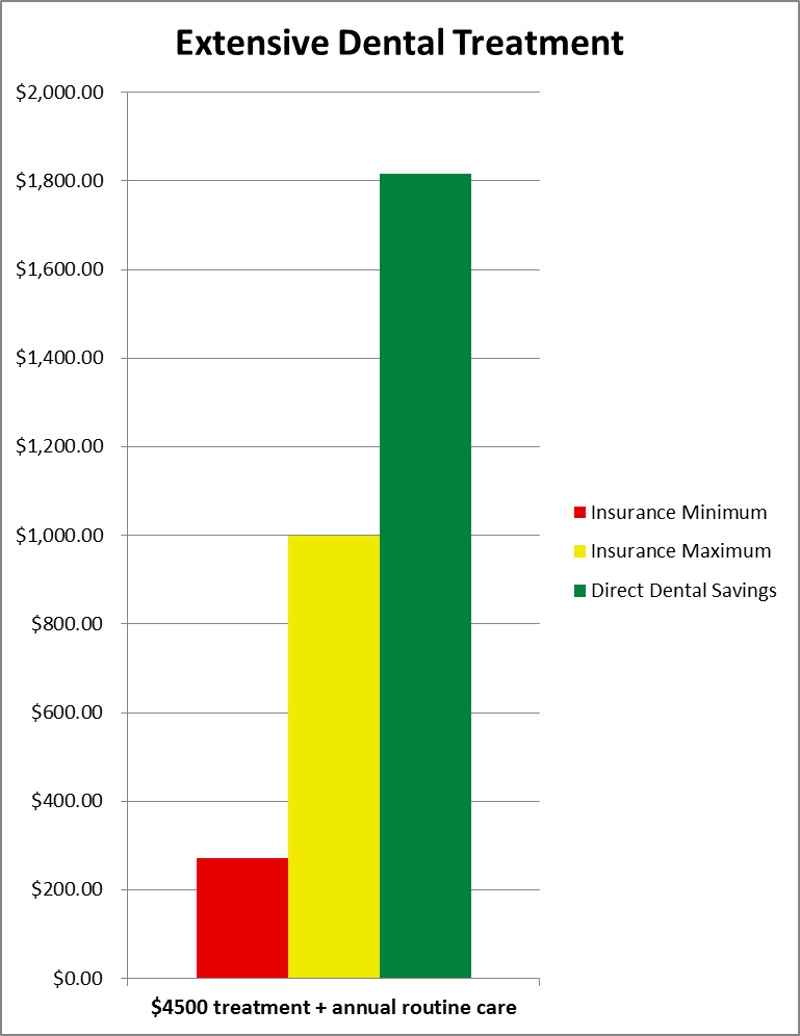

This is where your savings really add up! If you need extensive dental treatment, several thousand dollars or more, it’s a no-brainer. Dental insurance always has an annual maximum (as well as a fee schedule limitation and percentage reimbursement schedule). With Direct Dental Savings, there is no annual maximum (and no limited fee schedule), your savings are unlimited. If you need a lot of dental care, you can’t beat Direct Dental Savings!

This is where your savings really add up! If you need extensive dental treatment, several thousand dollars or more, it’s a no-brainer. Dental insurance always has an annual maximum (as well as a fee schedule limitation and percentage reimbursement schedule). With Direct Dental Savings, there is no annual maximum (and no limited fee schedule), your savings are unlimited. If you need a lot of dental care, you can’t beat Direct Dental Savings!

With a treatment totaling over $4500, Direct Dental Savings saved this individual over $800 from their insurance's maximum coverage.

If you need cosmetic or implant dentistry, Direct Dental Savings will save you dramatically more than insurance. In fact, insurance rarely covers implant care and virtually never covers cosmetic dentistry. Direct Dental Savings saves you 20% of your total costs on all these procedures. This can be many thousands of dollars depending upon the extent of treatment and your total treatment costs. Once again, Direct Dental Savings saves you more!

If you need cosmetic or implant dentistry, Direct Dental Savings will save you dramatically more than insurance. In fact, insurance rarely covers implant care and virtually never covers cosmetic dentistry. Direct Dental Savings saves you 20% of your total costs on all these procedures. This can be many thousands of dollars depending upon the extent of treatment and your total treatment costs. Once again, Direct Dental Savings saves you more!

With a treatment totaling $12,000, Direct Dental Savings saved this individual over $2,400 from their insurance's maximum coverage.